Posted by Weatherflow ● February, 2021

Tempest News | February 2021

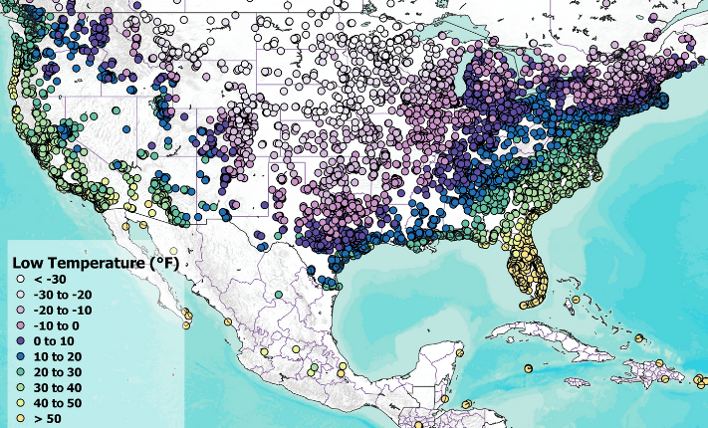

Tempest Network Low Temperatures

Tempest Network Low Temperatures

February 12-16, 2021

Texas Continues to Feel Impacts of Winter Storm

What started as an exciting glimpse of snowfall in Texas quickly turned for the worst as a severe winter storm hit the state. WeatherFlow Meteorologists monitored the Tempest network during the storm, and discuss the power grid structure in America and how adding more weather data can help utility companies take action to avoid similar grid failures in the future. Read More >>>

IT'S TIME FOR A NATIONAL PANDEMIC PREDICTION AGENCY

It’s an idea that’s been around since 2001 and proved more crucial than ever in the past year and a half: a pandemic prediction agency. Modeling and simulations could help us better prepare for future pandemics, not unlike the way the National Weather Service studies and predicts weather events. Read More >>>

COVID-19 Lockdowns Temporarily Raised Global TempERATURES

COVID-19 caused major lockdowns all over the world and a rapid decrease of activity within communities, but how did those factors affect our climate? A surprising finding shows that reducing the amount of pollutants emitted into our atmosphere slightly warmed the planet; highlighting the influence of aerosols that otherwise block the Sun’s warmth from reaching Earth. Read more >>

TEMPEST INNOVATOR OF THE MONTH

Dave Schmid loves three things: IoT gadgets, weather tech, and charts and graphs. He combined these to create dynamic historical weather dashboards using data from his Tempest Weather System. Read more >>

...with Founder and Director of the First Street Foundation, Matthew Eby.

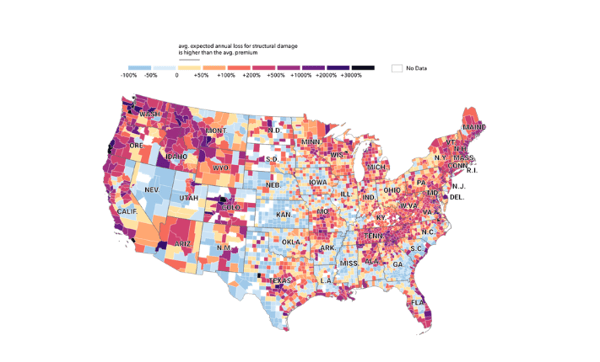

Think X Factor but for flood information! First Street Foundation is non-profit research group who have turned flood risk into a useful consumer tool. Their new report - ‘The Cost of Climate’ - published this week, builds on their database and quantifies the risk of floods to homeowners in the U.S.

FEMA currently classifies 8.7 million properties as having substantial risk of flood, but the First Street Foundation Flood Model identifies 14.6 million properties with the same level of risk. This means that nearly 6 million households and property owners are either in the dark or have underestimated their flood risk. First Street models also show that the number of homes at substantial risk will grow to 16.2 million by 2050.

With the Flood Factor® tool, anyone can enter their U.S. address and receive a flood risk report for your specific property. It's a game-changer for homebuyers but also for the real estate and insurance markets.

Q: Congratulations on the new data launch. Can you tell me about it?

A: First Street Foundation just published a study that has calculated the financial impact of flooding for every home in the country based on their flood risk level, the building characteristics, first-floor elevation, type of flooding, and other variables.

We then compare today's economic impact to the annual impact 30 years into the future, based on how the climate is changing. We have also compared our findings against flood insurance premiums offered through the National Flood Insurance Program (NFIP), overseen by FEMA, to compare our property damage calculations to their rates. As you may know, FEMA is preparing to change how they calculate premiums in October of this year. Risk Rating 2.0, as it will be known, will adjust flood insurance premiums to account for individual flood risk to homes, using a method very similar to ours.

Q:How COULD a homeowner OR SOMEONE IN THE MARKET FOR A NEW HOME use this data?

A: Our data can be used as an early indicator of areas that will be most impacted by these insurance rate changes, and how they will continue to increase into the future from climate change. Over 4 million homes will face annual financial losses from flooding that are 4.5 times their current NFIP premium, and that will increase to 6.2 times over the next 30 years. Said another way, 4.5 million homes could have their insurance go from roughly $980 a year to $4,400 a year.

Q: How long did it take to develop the first flood model? And what is so unique about it?

A: Our national flood model stands out for two major reasons: First, it is the most comprehensive model available anywhere, which fully couples flooding from every type of flood event. Second, our model climate-adjusts 30 years into the future, using the best available science on changing weather and its impact on flood risk. It was created over several years and based on decades of previous peer-reviewed work, thanks to a partnership with more than 80 world-renowned scientists, technologists and analysts. It incorporates risk from all major types of flooding, including high-intensity rainfall, overflowing rivers, and streams, high tides, and coastal storm surge.

The boundary, or "footprint" of the building is then used along with elevation data for the area to determine the likelihood of water on the ground reaching the lowest point of the home's footprint.

Q: I love the idea that people could use the tool to determine the value of a beachfront house using your model and CALCULATE THE years left before IT'S underwater (and weigh the purchase).

Exactly. Our model predicts risk over a 30 year period, or the life of a standard mortgage product, and is designed to provide insight into the types of flood risk a property faces. It is a probabilistic model intended to approximate flood risk to a property. Our semi-annual layer with a 30-year view would show you where you would anticipate water and the associated depth every other year over 30 years.

Q: The comparison of your data to FEMA is incredible. Can you tell me a bit more about that?

A: With regard to economic damage, we find that about 4 million homes face annual financial losses from flooding that are about 350%, or 4.5 times, the cost of their estimated national flood insurance premiums, today. This increases to a gap of 7.2 times over the next 30 years. Our data shows 14.6 million properties across the country at substantial risk (1% or greater), and 5.9 million of those property owners are currently unaware of or underestimate the risk they face because they are not identified as being within the SFHA zone.

Q: And so, are government agencies now relying on First Street data for emergency flooding situations and resettlement efforts?

We work with federal, state, and local government agencies to share our data and insights. We are presently talking to several federal agencies who have expressed interest in leveraging our data. First Street has partnered with leading real estate listing services, as well as federal agencies such as the U.S. Department of Energy, Environmental Protection Agency, the Federal Housing Finance Agency, and the Federal Reserve Bank of Atlanta, to share its data and unlock new insights that previously were not possible.

Q: It's AN INCREDIBLY useful tool for real estate buyers and sellers. Who do you find uses this information the most?

Flood Factor's goal was to provide a publicly available resource for your average American homeowners and home shoppers. Helping everyday people understand flood risk offers them the information they need to make an informed decision as they prepare to make what is likely to be the most significant investment of their lives. We are happy to say that millions of homeowners see our data daily through integrations with Realtor.com and Redfin.

In addition, our API is designed to allow researchers, other nonprofits, and interested third parties the opportunity to explore the models further. Users can make a "call" for all of the risk information available for a property based on an address or a latitude and longitude.

Q: What's next for the foundation?

In the near future, we hope to move on to other climate related hazards, building models to reflect the risk to homeowners from fire, heat, drought, and other threats associated with a changing climate.

Back to: Newsletter